In the fascinating realm of technical analysis for financial assets, one particular tool that has captivated traders and investors for centuries is Japanese candlesticks. These cryptic visual representations of price movements have provided valuable insights into market psychology and trends. Let’s embark on a journey through time to explore the history of Japanese candlesticks, from their humble beginnings to their modern-day significance.

Origins and Evolution:

The roots of Japanese candlesticks can be traced back to 17th-century Japan, where a rice merchant named Munehisa Homma first pioneered the art of technical analysis. Homma meticulously recorded the price movements of rice in the Dojima Rice Exchange, developing a rudimentary system to interpret market behavior. His observations laid the foundation for what would later evolve into the powerful tool we know today.

Over time, candlestick charting techniques were refined and expanded upon by other Japanese traders, notably Sokyu Honma and Goichi Hosoda. Their contributions introduced new candlestick patterns and concepts, solidifying the significance of this charting method.

Anatomy of a Candlestick:

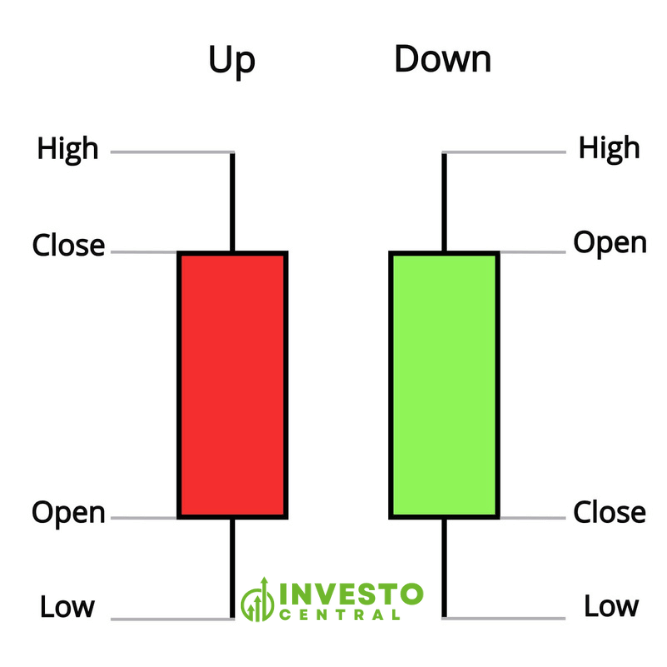

To grasp the essence of Japanese candlesticks, one must understand their fundamental components. Each candlestick consists of a rectangular body and two thin lines called shadows or wicks. The body represents the price range between the opening and closing prices of a financial instrument, while the shadows illustrate the highs and lows reached within a given time period.

Popularity and Spread:

Although initially confined to Japan, the merits of Japanese candlesticks gradually gained recognition beyond its borders. The pioneering work of Steve Nison, an American technical analyst, played a pivotal role in introducing this powerful charting method to the Western world. Nison’s book, “Japanese Candlestick Charting Techniques,” published in 1991, garnered widespread attention and sparked a global fascination with this ancient art of charting.

The simplicity and intuitiveness of Japanese candlesticks resonated with traders across various financial markets, from stocks to commodities and Forex. Their ability to provide a visual representation of market sentiment and potential reversals attracted both seasoned professionals and novices alike, further fueling the popularity of this technique.

Modern-Day Applications:

In the digital age, Japanese candlesticks have seamlessly integrated into the arsenal of tools used by traders and investors worldwide. Advanced charting software and platforms provide real-time candlestick charts, enabling users to analyze market trends with ease. The wide availability of educational resources has empowered individuals to master the art of interpreting candlestick patterns, making it an essential skill in the realm of technical analysis.

Today, candlestick patterns such as the doji, hammer, engulfing, and shooting star are widely recognized and applied by traders to identify potential entry and exit points in the markets. Their ability to reveal crucial information about market sentiment, support, and resistance levels has made them indispensable tools in the decision-making process of traders and investors.

Japanese candlesticks have come a long way since their inception in the rice markets of 17th-century Japan. From their humble origins to their modern-day ubiquity, these visual representations of price movements have left an indelible mark on the world of finance. Their simplicity, effectiveness, and visual appeal have made Japanese candlesticks an invaluable tool for chart analysis, aiding traders in deciphering market patterns and making informed decisions. So the next time you encounter a candlestick chart, take a moment to appreciate the rich history and timeless wisdom encoded within its elegant patterns.